Refinance mortgage and heloc calculator

Cash Out Refinance vs. See the Real Cost of Debt.

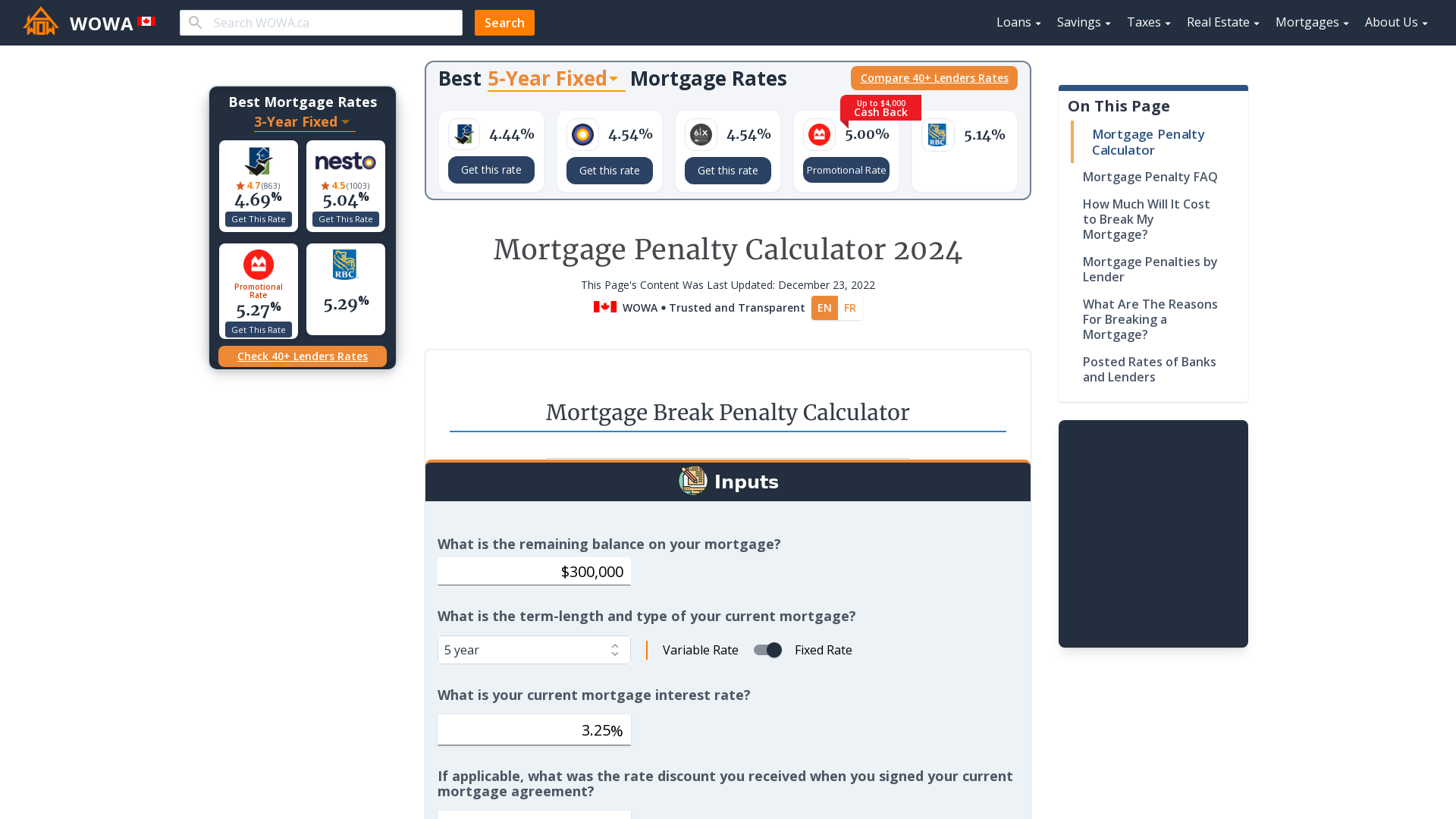

Canada Mortgage Refinance Calculator 2022 Wowa Ca

Our calculator includes amoritization tables bi-weekly savings.

. Your HELOC limit can be determined using the loan to value LTV ratio and remaining mortgage balance. Switching to a fixed-rate mortgage is one of the most common reasons to refinance. Paying off a mortgage with a HELOC is a method of refinancing a home loan.

The HELOC calculator is calculated based on your current HELOC balance interest rate interest-only period and the repayment period. The draw period is the phase. To do this the homeowner has to get approved for a HELOC with a credit limit as high as the amount required to pay off the mortgage.

When to consider a refinance of your reverse mortgage. Using a HELOC for Mortgage Payoff. A mortgage calculator can show you the impact of different rates on your monthly payment.

HELOC Payment Calculator excel to calculate the monthly payments for your HELOC loan. Change The Mortgage Term. For a 200000 mortgage refinance for example your closing costs could run.

Like a mortgage a HELOC is secured by the equity in your home. Estimate your monthly payments with PMI taxes homeowners insurance HOA fees current loan rates more. Cash Out Refinance vs.

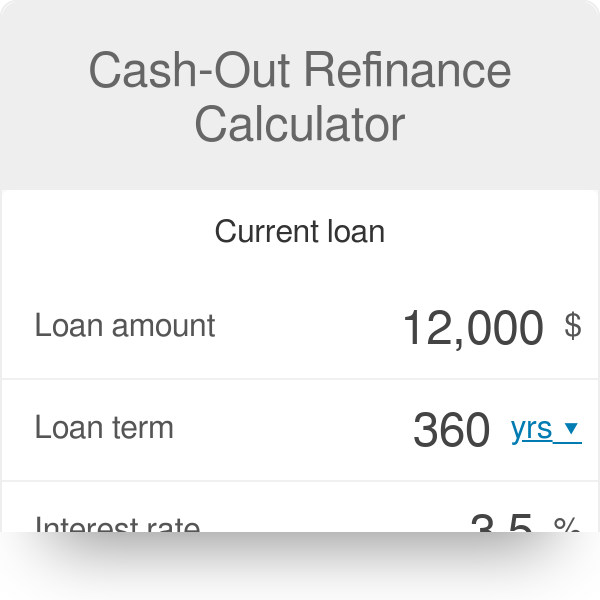

The HELOC repayment is structured in two phases. At Bankrate we strive to help you make smarter financial decisions. Cash-Out Refinance - A cash-out refinance allows a borrower to refinance his mortgage into a new mortgage that is larger.

Connect Facebook Instagram LinkedIn Glassdoor Zillow. This further shows how expensive debt is because most forms of consumer debt charge a far higher rate of interest than banks pay savers AND savers get taxed on interest income they earn at their ordinary tax rates. Switching to a fixed-rate mortgage is one of the most common reasons to refinance.

Refinancing to a fixed rate. Bankrates refinance calculator is an easy-to-use tool that helps estimate how much you could save by refinancing. As most mortgage brokers and lenders will cover your legal costs the main cost you need to worry about is your break of mortgage penalty known as the pre-payment penalty.

You originally obtained your loan when the lending limit was less than the 2022 Home Equity Conversion Mortgage HECM limit of 970800 and your value is at or higher than the HUD limit especially the limit that was in effect at the time you closed your loan. Refinancing to a fixed rate. Understand your options for taking equity out of your home.

HELOC Payments How are HELOC repayments structured. Some borrowers choose to refinance into a new HELOC at the end of the draw period. To determine if you can save money with a lower mortgage rate use our calculator to compare the monthly interest savings against the cost to refinance.

With rates rising I needed to refinance my variable rate mortgage - Ryan provided options and helped me get into a low fixed rate in a few weeks. Your home value has increased considerably. The above calculator also has a second tab which shows the current interest rates on savings accounts.

You can use a HELOC for just about anything including paying off all or part of your remaining mortgage balance. The average 30-year VA mortgage APR is 5820 according to Bankrates latest survey of the nations largest refinance lenders. Also offers loan performance graphs biweekly savings comparisons and easy to print amortization schedules.

Two mortgage payments can be unsustainable so you might want to search for a lower rate by refinancing. A home equity line of credit HELOC allows homeowners to borrow funds based on the equity they own in the home. Some of the factors that affect the timeline include the type and terms of the home loan youre requesting the types of documentation required in order to secure the loan and the amount of time it takes to provide your lender with those documents.

Check out the webs best free mortgage calculator to save money on your home loan today. Refinancing can give you access to lower rates if you can show that you are successfully managing your rental property. Unlike a mortgage a HELOC offers flexibility because you can access your line of credit and pay back what you use just like a credit card.

See how refinancing with a lower mortgage rate could save you money. Compare your current interest rate with offers from lenders before you refinance. Once approved for the HELOC the homeowner can draw on the credit limit to pay off the mortgage.

Every home loan situation is different so its hard to estimate how long your specific home mortgage process will take. In addition to the standard mortgage calculator this page. This may be to avoid the payment shock of the higher monthly payments required to repay both loan principle and ongoing interest charges but may also be done to just to keep the line of credit open.

Lower App Refi Calculator HELOC Calculator VA Calculator Secure Upload.

Home Equity Calculator Free Home Equity Loan Calculator For Excel

Lvhhh5sb5j4i0m

Home Equity Calculator Free Home Equity Loan Calculator For Excel

:max_bytes(150000):strip_icc()/dotdash-refinancing-vs-home-equity-loan-v2-7581ca7e240847fb972ef6efee18492e.jpg)

Cash Out Refinance Vs Home Equity Loan Key Differences

Downloadable Free Mortgage Calculator Tool

Home Equity Calculator Free Home Equity Loan Calculator For Excel

Home Equity Line Of Credit Heloc Rocket Mortgage

Home Equity Line Of Credit Heloc Rocket Mortgage

Home Equity Calculator Free Home Equity Loan Calculator For Excel

15 Year Mortgage Calculator Calculate Local 15 Yr Home Loan Refi Payments Nationwide

/dotdash-refinancing-vs-home-equity-loan-v2-7581ca7e240847fb972ef6efee18492e.jpg)

Cash Out Refinance Vs Home Equity Loan Key Differences

Heloc Calculator Calculate Available Home Equity Wowa Ca

Cash Out Refinance Calculator

Downloadable Free Mortgage Calculator Tool

Home Mortgage Refinance Calculator Current Mortgage Loan Refinancing Rates

Home Equity Line Of Credit Qualification Calculator

What Is A Home Equity Line Of Credit Or Heloc Nerdwallet