Commercial debt service ratio calculator

Lets say a company has a debt of 250000 but 750000 in equity. On the other hand a business could have 900000 in debt and 100000 in equity so a ratio of 9.

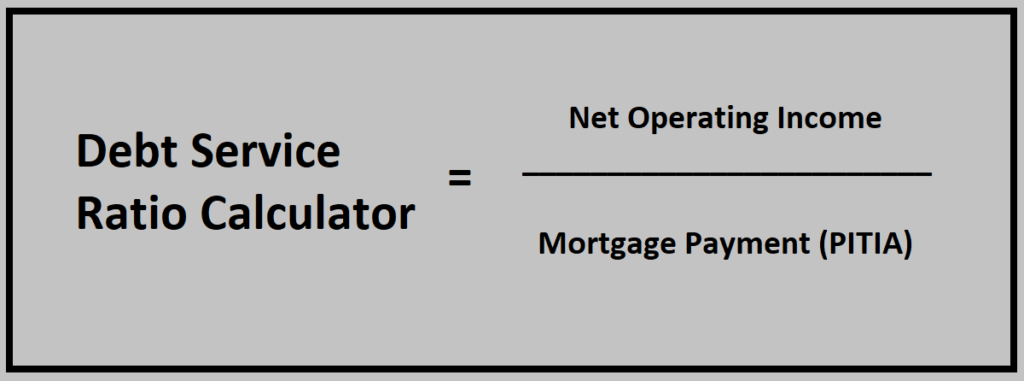

How To Calculate The Debt Service Coverage Ratio Dscr Propertymetrics

What Is Debt Service Ratio DSR.

:max_bytes(150000):strip_icc()/DSCR5-d5bf42881e1348a48cc306f6fdc92d6f.jpg)

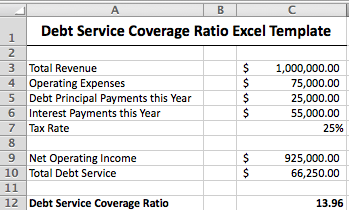

. Welcome to our commercial mortgage calculator. Its a very low-debt company that is funded largely by shareholder assets says Pierre Lemieux Director Major Accounts BDC. In this example net operating income is 1 million and debt service is 200000.

For example a DSCR of 92 means that there is only enough NOI to cover 92 of annual debt service. We will calculate the debt service coverage ratio of ILandFS Engineering and Construction Company. Use this Debt to Equity Ratio Calculator to calculate the companys debt-to-equity ratio.

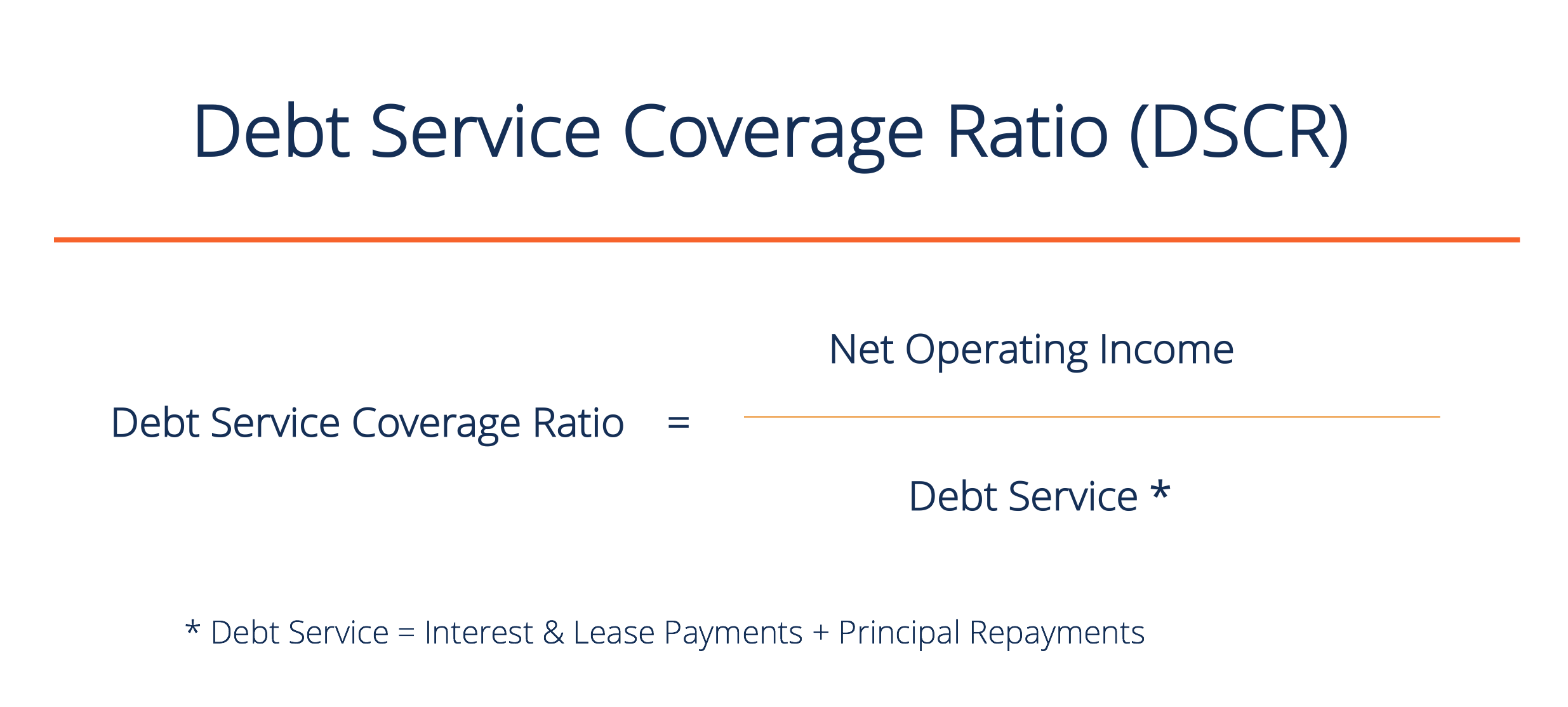

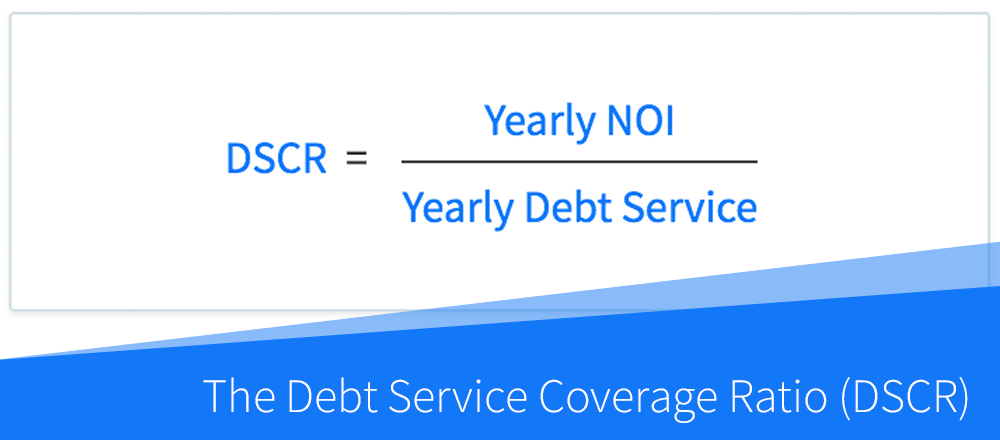

Generally commercial real estate loans come with a loan-to-value ratio LTV of around 65 to 80. Most commercial banks and equipment finance firms want to see a minimum of 125x but strongly prefer something closer to 2x or more. The Debt Service Coverage Ratio measures how easily a companys operating cash flow can cover its annual interest and principal obligations.

Credit Analysis Leverage Ratio Interest Coverage Ratio Solvency Ratio Debt to Equity Ratio DE Net Debt Times Interest Earned TIE Ratio Cash Flow Available for Debt Service CFADS Debt Service Coverage Ratio DSCR Debt Capacity Debt Covenants Collateral Default Risk Loss Given Default LGD Fixed Charge Coverage Ratio FCCR. Ratibi Service 600522298. Here you can calculate your monthly payment total payment amount and view your amortization schedule.

If an income-producing property has a DSCR of less than 1x that. A DSCR of 4361 indicates that the company has enough cash to cover its debt obligations. Use our loan calculators including debt burden ratio now and apply today.

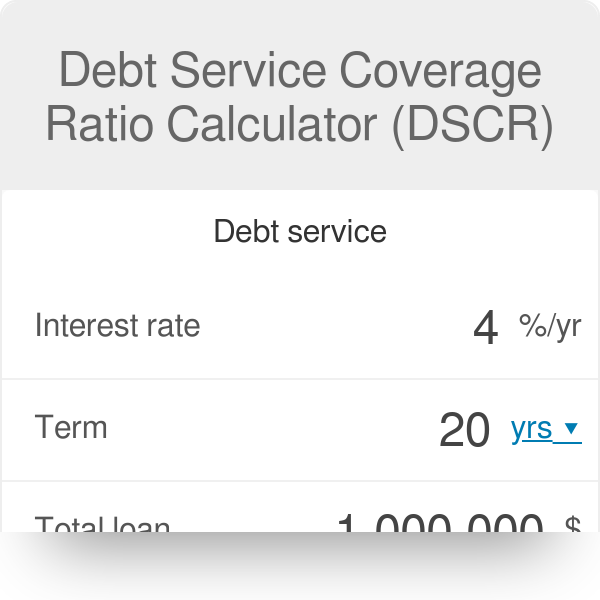

This simple debt service coverage ratio calculator determines the DSCR for any commercial real estate financing. Go ahead and simply enter your details into our Loan Calculator - its a great way to get an idea of how much you can borrow and what your monthly repayments would be. It is of great importance in real estate or commercial lending as this ratio gives us an idea about the maximum loan amount a.

For commercial lenders the debt service coverage ratio or DSCR is the single-most significant element to take into consideration when analyzing the level of risk attached to an investment property or business. Examples of debt-to-equity calculations. The current ratio limit is 2941.

1000000 200000 5. In general commercial lenders look for DSCRs of at least 125 to ensure adequate cash flow. Its debt-to-equity ratio is therefore 03.

This ratio means that 29 of your pre-tax income can go to interest insurance principle taxes and HOA dues. Our DSCR calculator enables you to calculate your companys debt service coverage ratio DSCR with ease. Essentially your DTI ratio takes into consideration your full debt exposure ensuring you can meet your home loan repayments today and in the future.

An example can help you understand how to calculate DSCR. The debt-to-income ratio compares how much pre-tax income you have coming in each month and subtracting all of your financial obligations. Cash needed to pay required principal and interest of a loan during a given period.

The DSR meaning can be put simply as a method used by banks to calculate whether or not you can afford the loan youre applying for. For example lets say youre a couple each earning a yearly gross income of 80000 each 160000 in total you want to borrow 500000 and your total liabilities are. For example if the property is appraised at 200000 and the lender requires a 70 LTV youll be expected to put down 60000 to receive a loan of 140000.

Debt to Equity Ratio short term debt long term debt fixed payment obligations Shareholders Equity Debt to Equity Ratio in Practice If as per the balance sheet the total debt of a business is worth 50 million and the total equity is worth 120 million then debt-to-equity is 042. Corporate Finance Institute. In terms of a home loan this formula essentially helps the bank estimate how much you can afford to fork out for your monthly instalments.

In multifamily and commercial real estate debt service coverage ratio or DSCR is a measurement of a propertys cash flow in relation to its debt obligations. Including the property type location leverage debt service coverage ratio personal financial strength and how much of a financial relationship you are willing to establish with the.

How To Calculate Dscr Ratio From Balance Sheet How To Calculate Debt Service Coverage Ratio From Bs Youtube

:max_bytes(150000):strip_icc()/DSCR-b224f0db64184eae800e27598a8bc2d7.png)

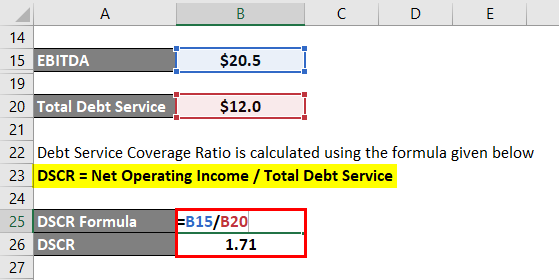

How To Calculate Debt Service Coverage Ratio Dscr In Excel

How To Calculate The Debt Service Coverage Ratio Dscr Propertymetrics

:max_bytes(150000):strip_icc()/DSCR5-d5bf42881e1348a48cc306f6fdc92d6f.jpg)

How To Calculate Debt Service Coverage Ratio Dscr In Excel

Debt Service Coverage Ratio Dscr Formula Example Excel Template

Debt Service Coverage Ratio Calculator Dscr

What Is Debt Service Coverage Ratio Free Calculator Included

Calculate The Debt Service Coverage Ratio Examples With Solutions

How To Calculate The Debt Service Coverage Ratio Dscr In Real Estate Dealcheck Blog

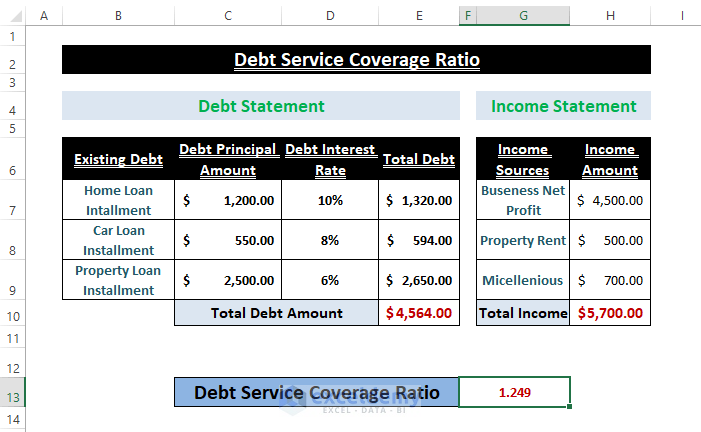

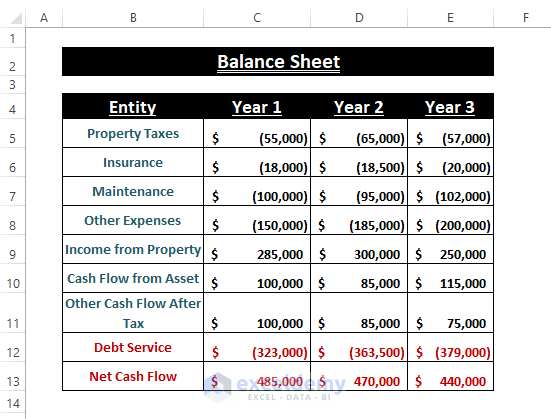

Debt Service Coverage Ratio Formula In Excel Exceldemy

How To Calculate Debt Service Coverage Ratio Dscr

Dsr Loan For Investment Properties Debt Service Ratio Calculator

Debt Service Coverage Ratio Calculate Dscr With Practical Examples

How To Calculate The Debt Service Coverage Ratio Dscr Propertymetrics

/DSCR-b224f0db64184eae800e27598a8bc2d7.png)

How To Calculate Debt Service Coverage Ratio Dscr In Excel

Debt Service Coverage Ratio Calculate Dscr With Practical Examples

Debt Service Coverage Ratio Formula In Excel Exceldemy